In this circumstance, we assume that the sale quantity is not changed. However, in real life, the selling price and quantity are closely related. The selling quantity will increase if we decrease the price and vice versa. Even if you hit your sales as a dependent 2020 target in terms of volume, there is still a possibility that you‘ll miss your revenue target. If you’re not calculating sales variance, your revenue target will be at risk, and you won’t have the information you need to pivot your sales strategy.

How confident are you in your long term financial plan?

The overall increase of $268 in Profit margin can be clearly explained with Price increase resulting in fav. So, we can say out of total change in profit margin of $268, Price variance represents $113 (rounded), and we can also see that oranges are the largest contributors to the fav. Calculating sales variance for the products your company offers is a worthwhile activity for each sales period to ensure you are on track with your revenue goals. From this calculation, we can see there was a negative variance of $900 from the sale of new subscriptions to your service. This means the company brought in $900 less than originally anticipated during this sales period. Here is how to calculate the sales price variance of a particular product.

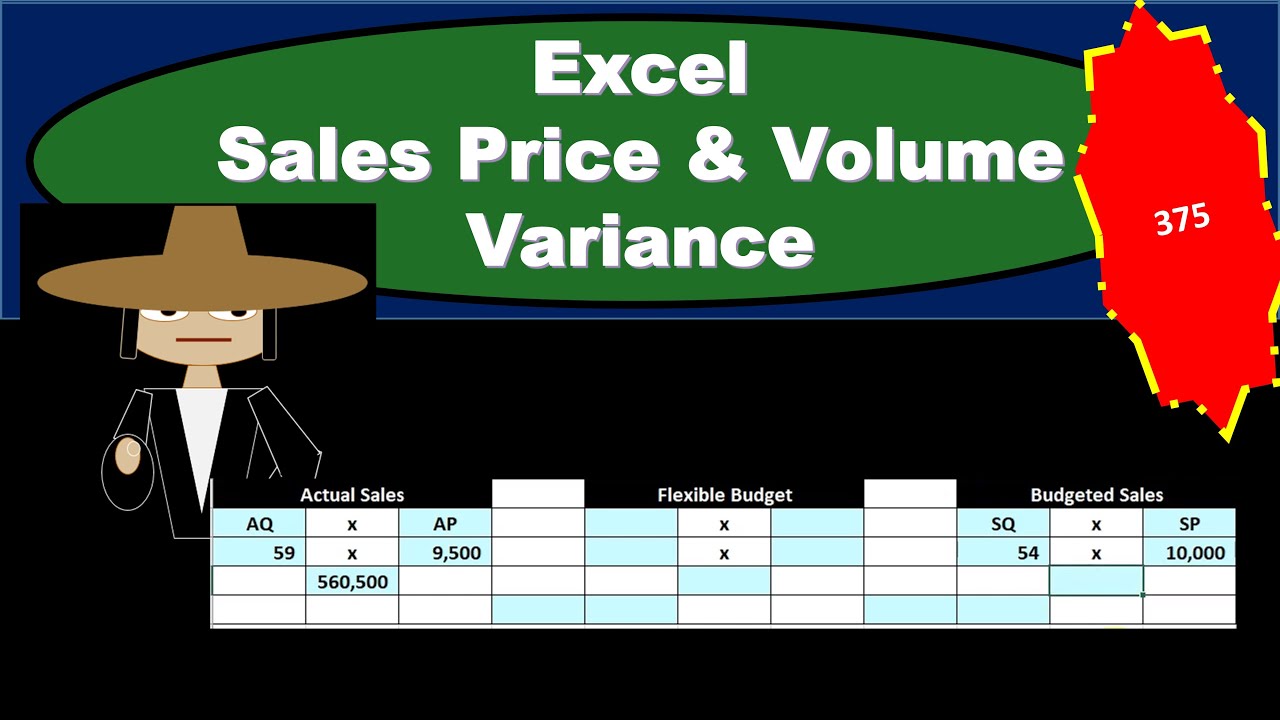

How to Calculate Sales Price Variance? The formula, Example, And Analysis

In this instance, you work for a company that sells subscriptions to an online music streaming service. The founder of your company has a background in entertainment law and was able to secure the widest selection of music available—featuring numerous artists and albums that are unavailable on any other streaming platform. A favorable variance occurs due to a more-than-expected customer’s acceptance of the product, fewer competitors, and a successful marketing campaign. When the demand for the product is initially high, businesses increase the price. Sales price variance is a measure of the gap between the price point a product was expected to sell at and the price point at which the product was actually sold. The variance can be favorable, meaning the price was higher than anticipated, or unfavorable, meaning the price failed to meet expectations.

Sales Variance Analysis in Accounting

It helps them plan whether to provide discounts or to raise the prices of the product. Although this scenario can be disappointing, it is a reality of doing business, especially for those companies in competitive markets. However, our analysis is not finished, and we need to understand the impact of Mix and Quantity. However, we need to still calculate it, as well as the two sub Volume variances, which are Quantity and Mix. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

- Sale price variance is the difference between the standard price and the actual price that the company has sold the product.

- The sales variance formula shows that the variance is positive and therefore a favorable variance.

- In this article, I am going to explain with the help of an example, how to calculate sales variances, and how to understand the impact of these variances on the profitability of your business.

- After one month, the plants are selling above projections due to a viral TikTok review, and the demand for your product is sky-high.

- Often, companies sell their product at a particular price, known as the budgeted or targeted price.

Sales Quantity Variance: Definition, Formula, Explanation, And Example

The shirts are sitting on the shelves and not selling very quickly, so the store chooses to discount them to $15 each. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Analysis:

To allow time for your manufacturing team to restock, you raise prices to $35. Large and small businesses prepare monthly budgets that show forecasted sales and expenses for upcoming periods. When multiplied by the actual volume 13,500 the sales price variance is determined as 9,450. It should be noted that the term standard is also used when referring to unit prices, so budgeted price in the above formula could be replaced with the term standard price.

It‘s important to note that the two types of sales volume variance can be intertwined and impact each other. You can have both sales price variance and sales volume variance together, or one of each, at a time. In fact, it may be an advantageous sales strategy to strive for one type of variance if you’re changing the positioning of a product, entering a new market, or if you’ll have a better chance at achieving a high-impact goal. The selling price variance ratio compares the actual selling price and the budgeted price. It is calculated by dividing the actual selling price by the budgeted selling price or vice versa. The sales price variance is an essential analytical tool for businesses.

Initially, your company budgeted to sell 1,000 subscriptions for $9 per month. This resulted in the competitor gaining additional market share right before the launch of your company’s new music catalog. After a month of promoting the new catalog and charging $9 per subscription, you were able to sell 900 new subscriptions. Using the formula, we can calculate sales volume variance for the music service subscription. On the other hand, when unfavorable sales variance occurs it is because a company charges less for their product compared to what was budgeted.

Actual sales can differ from budgeted sales either because the company has not been able to sell the budgeted number of units or because the price it received in the market was different what it had expected. The sales price variance quantifies the difference in sales that results from the difference in market price and standard price. Sales price variance is the difference between the price at which a business expects to sell its products or services and what it actually sells them for. Sales price variances are said to be either “favorable,” or sold for a higher-than-targeted price, or “unfavorable” when they sell for less than the targeted or standard price. The sales price variance formula shows that the variance is positive and therefore a favorable variance. The actual price (5.50) is greater than the budgeted price (4.80) by 0.70 per unit.